The Buzz on Eb5 Investment Immigration

The Buzz on Eb5 Investment Immigration

Blog Article

8 Simple Techniques For Eb5 Investment Immigration

Table of ContentsRumored Buzz on Eb5 Investment ImmigrationOur Eb5 Investment Immigration DiariesThe Definitive Guide to Eb5 Investment Immigration7 Simple Techniques For Eb5 Investment ImmigrationThe Basic Principles Of Eb5 Investment Immigration

While we aim to use precise and current content, it should not be taken into consideration lawful suggestions. Migration laws and laws go through transform, and individual situations can vary extensively. For customized guidance and legal advice regarding your details immigration circumstance, we strongly advise speaking with a qualified migration lawyer that can provide you with tailored aid and ensure conformity with current regulations and laws.

Citizenship, with financial investment. Currently, as of March 15, 2022, the quantity of financial investment is $800,000 (in Targeted Employment Locations and Country Areas) and $1,050,000 elsewhere (non-TEA areas). Congress has actually approved these amounts for the next 5 years beginning March 15, 2022.

To receive the EB-5 Visa, Capitalists must produce 10 full time U.S. work within two years from the date of their full financial investment. EB5 Investment Immigration. This EB-5 Visa Need guarantees that financial investments add straight to the united state job market. This uses whether the work are created straight by the business or indirectly under sponsorship of a designated EB-5 Regional Center like EB5 United

About Eb5 Investment Immigration

These tasks are established through versions that utilize inputs such as advancement costs (e.g., building and equipment expenses) or annual earnings produced by recurring procedures. On the other hand, under the standalone, or straight, EB-5 Program, just direct, permanent W-2 staff member placements within the company may be counted. A vital threat of counting solely on direct employees is that personnel reductions due to market problems can lead to inadequate full-time positions, potentially resulting in USCIS rejection of the financier's application if the work production requirement is not fulfilled.

The financial model then forecasts the number of straight tasks the new service is most likely to produce based upon its awaited revenues. Indirect work computed via financial versions describes work created in sectors that provide the products or services to business directly included in the job. These tasks are produced as an this link outcome of the increased demand for products, products, or services that sustain business's operations.

Our Eb5 Investment Immigration Diaries

An employment-based fifth choice group (EB-5) investment visa offers an approach of ending up being an irreversible U.S. homeowner for foreign nationals intending to invest funding in the USA. In order to obtain this permit, a foreign capitalist should spend $1.8 million (or $900,000 in a Regional Center within a "Targeted Work Area") and develop or protect at the very least 10 full-time work for United States employees (excluding the financier and their prompt family).

Today, 95% of all EB-5 capital is elevated and spent by Regional Centers. In numerous areas, EB-5 financial investments have filled up the financing gap, offering a new, vital resource of capital for neighborhood economic advancement tasks that revitalize communities, develop and sustain jobs, framework, and solutions.

The Single Strategy To Use For Eb5 Investment Immigration

More than 25 countries, including Australia and the United Kingdom, use similar programs to attract foreign investments. The American program is extra rigid than numerous others, requiring significant threat for capitalists in terms of both their monetary investment and immigration condition.

Family members and individuals who seek to move to the United States on a permanent basis can apply for the EB-5 Immigrant Financier Program. The United States Citizenship and Migration Solutions (U.S.C.I.S.) established out various needs to obtain permanent residency via the EB-5 visa program.: The initial step is to find a certifying financial investment possibility.

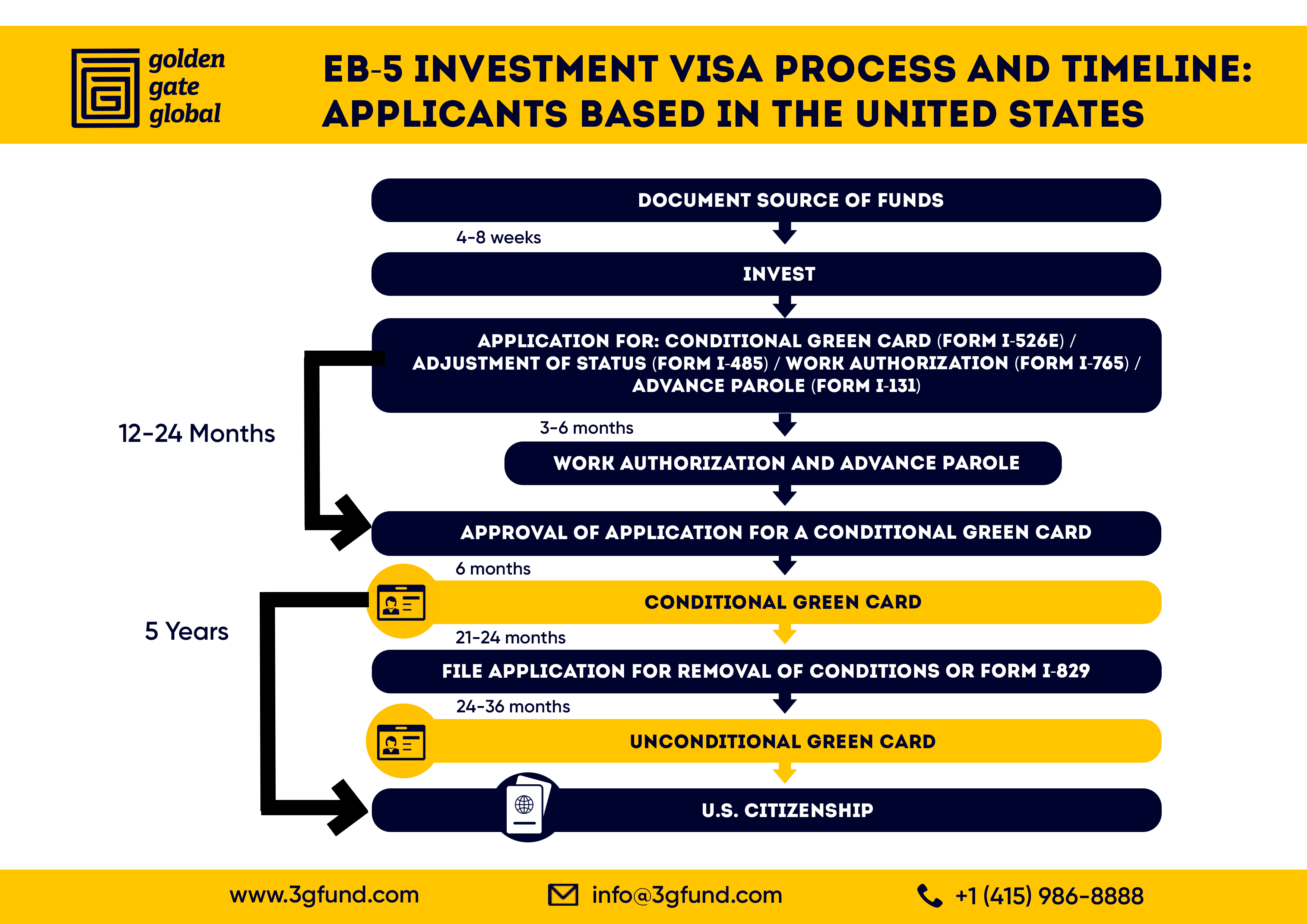

Once the opportunity has been determined, the capitalist has to make the investment and submit an I-526 petition to the U.S. Citizenship and Immigration Solutions (USCIS). This request her latest blog needs to consist of proof of the financial investment, such as financial institution declarations, acquisition arrangements, and business strategies. The USCIS will certainly review the I-526 petition and either authorize it or demand additional evidence.

What Does Eb5 Investment Immigration Do?

The investor must use for conditional residency by sending an I-485 application. This request must be sent within 6 months of the I-526 approval and must consist of evidence that the investment was made which it has created at the very least 10 full time jobs for united state workers. The USCIS will certainly examine the I-485 request and either approve it or demand additional evidence.

Report this page